Download the full Partner Moves Issue here >>

Welcome to the 79th edition of Law Firm Partner Moves in London, from the specialist partner team at Edwards Gibson, where we look back at announced partner-level recruitment activity in London over the past two months and give you a ‘who’s moved where’ update.

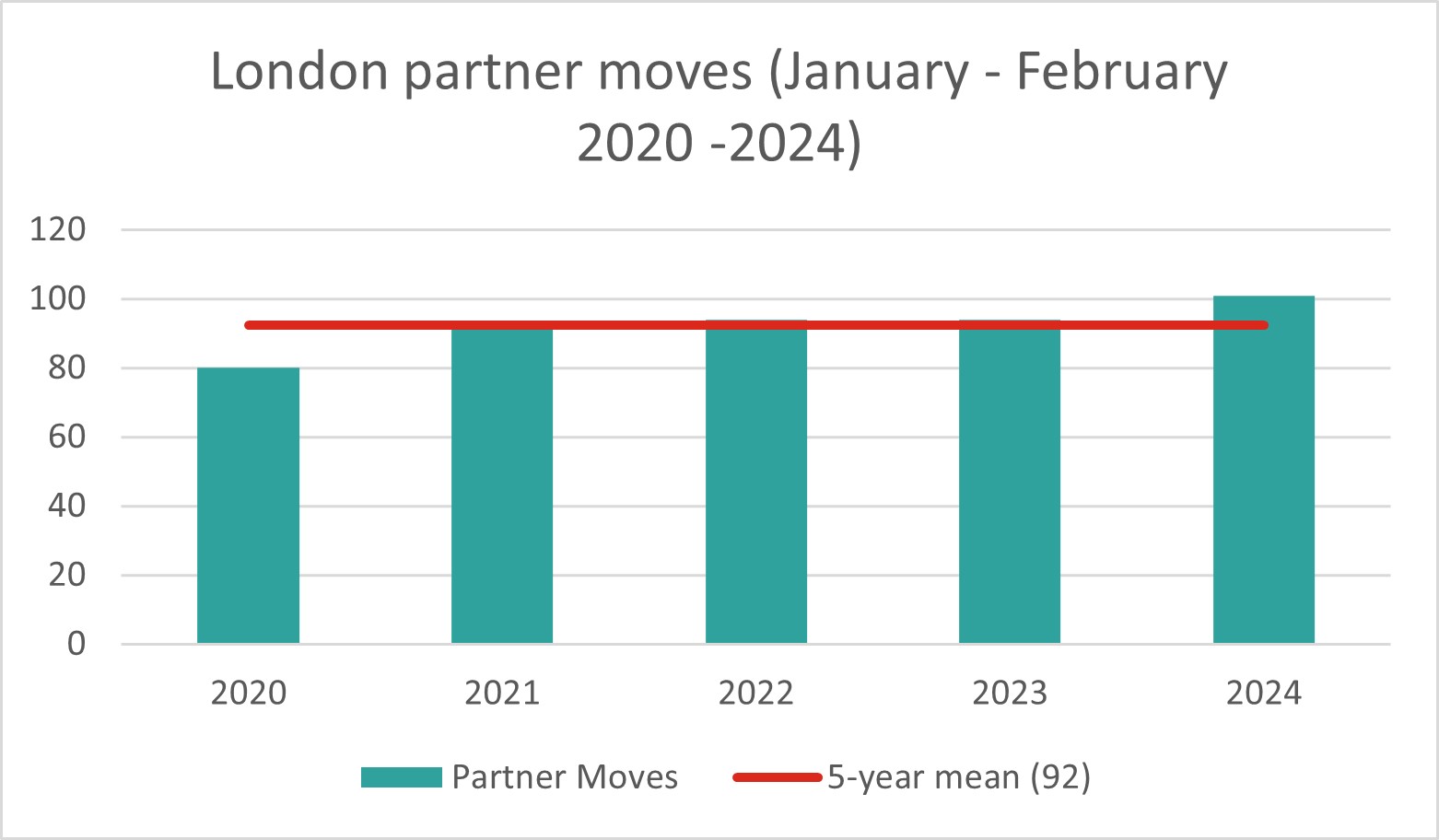

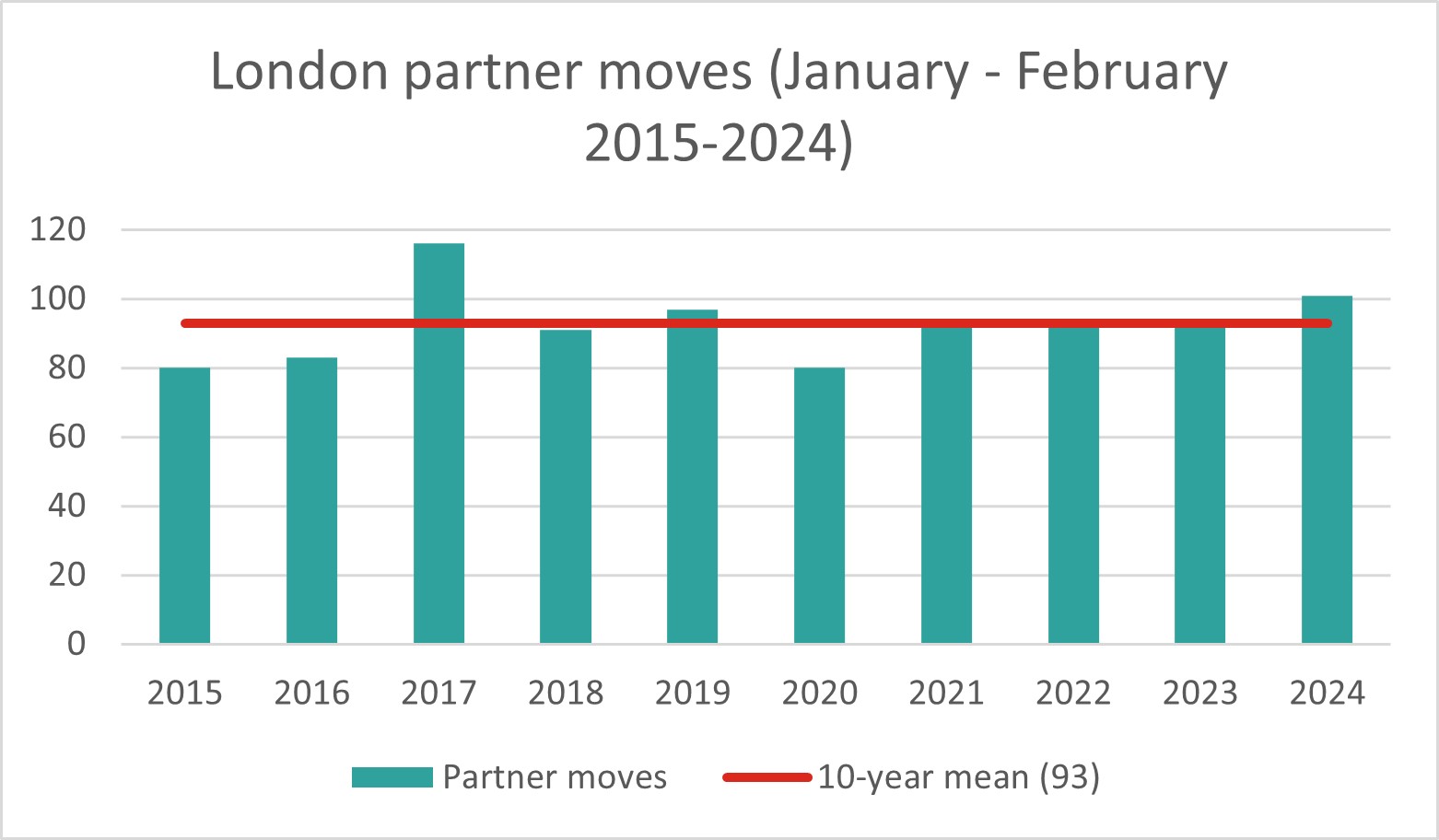

This bi-monthly round-up contains 101 partner moves – an increase of 7% on the number of hires we saw during the same period last year (94), and up 9% on the cumulative five-year and ten-year averages - 92 and 93 respectively. Indeed, the rate of hiring is the second highest on record – bettered only by 2017, when the figures were artificially inflated following the collapse of KWM’s European verein.

As reported in our last edition, despite a relatively soft market for transactional legal services, 2023 was a record year for law firm partner moves which were in large part driven by countercyclical investments by US law firms in private equity related hires. In the first two months of this year, that same dynamic has continued to fuel the red-hot law firm partner hire market.

The most covetous firm this edition was Pinsent Masons, which hired five partners, followed by: Charles Russell Speechlys, DLA Piper, Fried Frank, Kirkland & Ellis and White & Case, which hired four partners apiece.

- Team hires

The largest multi-partner team move this round-up was Fried Frank’s addition of a peripatetic private equity trio, led by Christian Iwasko, which arrived from Goodwin Procter after previous joint stints at Sidley Austin and Kirkland & Ellis.

Five other firms hired two-partner teams: Bryan Cave Leighton Paisner (corporate energy and energy finance from Locke Lord); DLA (energy and infrastructure from Paul Hastings); Hunton Andrews Kurth (energy and infrastructure from EY Law); Paul Hastings (disputes and corporate crime from Latham & Watkins); and Pinsent Masons (TMT from Deloitte Legal).

- Top partner recruiters in London January-February 2024

| Pinsent Masons | 5 | (3 laterals) |

| Charles Russell Speechlys | 4 | (4 laterals) |

| DLA Piper | 4 | (4 laterals) |

| Fried Frank | 4 | (3 laterals) |

| Kirkland & Ellis | 4 | (1 lateral) |

| White & Case | 4 | (3 laterals) |

| Bird & Bird | 3 | (1 lateral) |

| Mishcon de Reya | 3 | (2 laterals) |

| Paul Weiss | 3 | (3 laterals) |

| Simmons & Simmons | 3 | (2 laterals) |

Paul Hastings saw the highest attrition – losing a half dozen laterals in the first two months of 2024, followed by Deloitte Legal, Goodwin Procter and Pinsent Masons, which each lost 3 London partners.

- Firms with highest attrition in London (laterals only) January – February 2024

| Paul Hastings | 6* |

| Deloitte Legal | 3 |

| Goodwin Procter | 3 |

| Pinsent Masons | 3 |

*Includes a partner who retired from the partnership in 2023

- All Weiss then, let’s continue …

The fiery re-launch of Paul Weiss’s London office continued apace with the New York firm indulging its twin passions of moving fast and breaking things, whilst at the same time adding to its collection of Kirkland & Ellis and Linklaters alumni; last year’s top partner hirer in the London market kicked off the new year by ripping three more laterals from: Linklaters, Ropes & Gray (albeit a former Kirkland & Ellis partner) and, according to Law.com, a private funds partner from Kirkland & Ellis.

The additional hires mean that the London market’s new apex predator has hired no fewer than 17 laterals since August last year from: Kirkland & Ellis (11); Linklaters (3); Clifford Chance (2) and Ropes & Gray (1).

- (Magic) circling the wagons …

As we mentioned in our last edition, last year Linklaters lost a dozen partners to rivals in London (of whom it would probably have preferred to have kept nine). The first two months of 2024 have seen the Magic Circle firm lose two more “keepers” both to US firms - Gibson Dunn and Paul Weiss.

In January it came to light that Linklaters was seriously considering changing its compensation structure so as to enable it to effectively "lock-in” partners who want to defect to competitors by withholding their retained profits. The idea, mooted as a direct response to the high number of lateral partner departures Linklaters has suffered at the hands of US rivals, is indicative of just how threatened one member of the Magic Circle has become in its home market; see Linklaters – Welcome to the “Hotel California” of Big Law; “You can check out anytime you like but you can never leave”.

Aside from looking extremely weak – an unhelpful image for a firm desperately trying to break into the US market – should Linklaters’ proposal be implemented, it would put the firm at a considerable disadvantage when hiring laterals from US law firms. This is because most elite US law firms pay final profit distributions very shortly after the end of the financial year in which it was earned; in contrast, most UK law firms generally withhold profits and distribute them in aliquots over the following 12 months (i.e. in arrears). So, even where headline compensation is the same, the cashflow for new equity partners at UK firms is always worse … if one adds in the concept that those (already delayed) distributions can be negated altogether, you have something akin to a recruitment Chernobyl!

Whilst we are (fairly) certain that the 16th century Court of Chancery justices who developed the concept of “equity” probably didn’t have Linklaters equity partnership foremost in mind, a jurisprudential maxim from that forum which every law student should know is, “he who comes to equity must come with clean hands”.

Lastly, it seems passing strange that a firm which is itself highly active in the lateral market is even discussing distribution lock-ins for its own partners. Last year Linklaters hired six partners in London, three of whom were laterals from US rivals - Kirkland & Ellis, Latham & Watkins and Shearman & Sterling. Moreover, the Magic Circle firm has recently trumpeted the breaking of its once sacrosanct lockstep precisely in order to facilitate the poaching of laterals in the US market. Whilst we are (fairly) certain that the 16th century Court of Chancery justices who developed the concept of “equity” probably didn’t have Linklaters equity partnership foremost in mind, a jurisprudential maxim from that forum which every law student should know is, “he who comes to equity must come with clean hands”.

Overall, this edition sees the Magic Circle come out flat against its US rivals. The two departures from Linklaters (to Gibson Dunn and Paul Weiss), and one from Freshfields (also to Gibson Dunn) are offset by: Allen & Overy, Clifford Chance and Freshfields hiring from Milbank, Paul Hastings and Akin respectively.

- Also of note in this edition

- 38% (38) of all hires were female.

- 29% (29) of all hires were non-partners moving into partnership.

- 6 firms hired from in-house this edition: Addleshaw Goddard (from the Bank of England), Bracewell (from BP), Morrison & Foerster (from Deutsche Bank), Pinsent Masons (from Royal London), RPC (from Associated Newspapers Ltd.), and Stephenson Harwood (from Natixis Investment Managers).

- Market outlook

The red-hot Biglaw partner hire market that we have seen in the first two months of 2024 is, in large part, simply a continuation of the record year we saw in 2023 when law firms bet heavily on the expectation that inflation, and therefore global interest rate hikes, would prove temporary and that their inevitable fall would presage a return to private equity led deal making. These counter-cyclical partner-led investment hires, whereby law firms essentially bought future books of business, remain in stark contrast to the recruitment market for junior lawyers which more accurately reflects the softer “real time” demand for transactional legal services relative to the “post-Covid bounce”.

Most of the 101 hires detailed in this report would have been finalised, or at least at very advanced stages, at the end of last year. This time-lag between acceptance of offer and start date is due to a combination of UK firms having long notice periods, and partners at US law firms (with calendar year ends and short notice periods), waiting for final distribution payments / year-end bonuses before resigning.

For this reason, whilst our January-February “the transfer season” edition always tends to record the highest number of moves in any given year, because these hires are often made months in advance, it is often not a particularly reliable barometer for the actual “real time” demand for partners. Nevertheless, at the time of writing, the partner hire market remains very robust, and not just in transactional areas linked to private equity led investment, but also in disputes and restructuring where, thanks to a UK economy which is now technically in recession, the partner recruitment market is probably more reflective of the actual real time demand for legal services.

Please do not hesitate to contact us if you would like to discuss this article or any other aspect of the market in more depth.

Scott Gibson, Director scott.gibson@edwardsgibson.com or +44 (0)7788 454 080

Sloane Poulton, Director sloane.poulton@edwardsgibson.com or +44 (0)7967 603 402

Please click here to understand our methodology for compiling Partner Moves

Download the full Partner Moves Issue here >>

If you would like to subscribe to our Partner Moves Newsletter, email us at support@edwardsgibson.com

Edwards Gibson Partner Round-Up - Our Methodology

Edwards Gibson Partner Round-Up - Our Methodology Previous editions of Partner Moves in London

Previous editions of Partner Moves in London Quantifying your following and writing an effective law firm business plan

Quantifying your following and writing an effective law firm business plan Specimen partner business plan template

Specimen partner business plan template The Partnership Track and Moving for Immediate Partnership

The Partnership Track and Moving for Immediate Partnership Legal directory rankings and their effect on lawyer recruitment

Legal directory rankings and their effect on lawyer recruitment Restrictive Covenants and Moving on as a Partner

Restrictive Covenants and Moving on as a Partner

Linklaters – Welcome to the “Hotel California” of Big Law; “You can check out anytime you like but you can never leave”

Linklaters – Welcome to the “Hotel California” of Big Law; “You can check out anytime you like but you can never leave” Parallels in Peril, two midsize law firms – Axiom Ince and Stroock & Stroock & Lavan – collapse in the same month

Parallels in Peril, two midsize law firms – Axiom Ince and Stroock & Stroock & Lavan – collapse in the same month And you thought $20 million was a lot for a lawyer…

And you thought $20 million was a lot for a lawyer… Legal Upheaval: Kirkland & Ellis and Paul Weiss Exchange Blows

Legal Upheaval: Kirkland & Ellis and Paul Weiss Exchange Blows So, it’s A&O Shearman!

So, it’s A&O Shearman! Real Estate lawyers - beware the £1,000 fish, and the true meaning of MIPIM … (literally)

Real Estate lawyers - beware the £1,000 fish, and the true meaning of MIPIM … (literally)