Download the full Partner Moves Issue here >>

Welcome to the 90th edition of Law Firm Partner Moves in London, from the specialist partner team at Edwards Gibson, where we look back at announced partner-level recruitment activity in London over the past two months and give you a ‘who’s moved where’ update. Our records go back to 2007, and this is our methodology. This edition concludes our Law Firm Partner Moves in London for 2025 and we have included some facts and figures below comparing this year’s partner-level recruitment activity with that over the past ten years.

- A summary of 2025

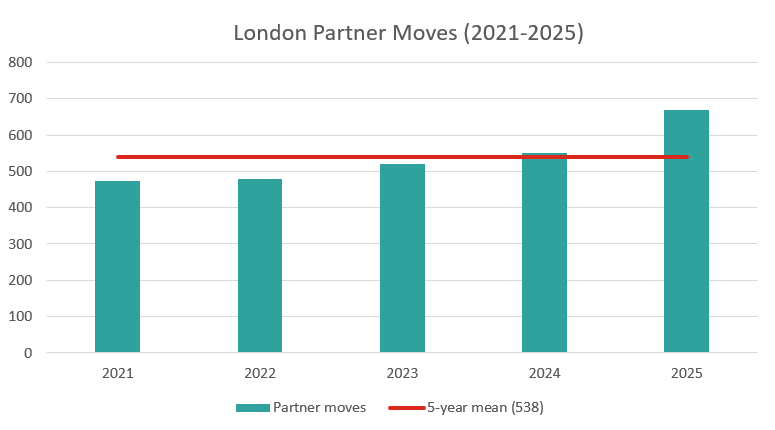

There were 668 partner moves announced in 2025. Our records go back to 2007, and this is by far the highest number ever recorded in a single year – 21% up on the previous record - 551 - which was set last year, and 24% and 36% up on the cumulative five and ten-year averages respectively.

This upward surge continues an escalating three-year bull run of law firm partner hires in London - the cyclical and structural reasons for which we explore in more detail below.

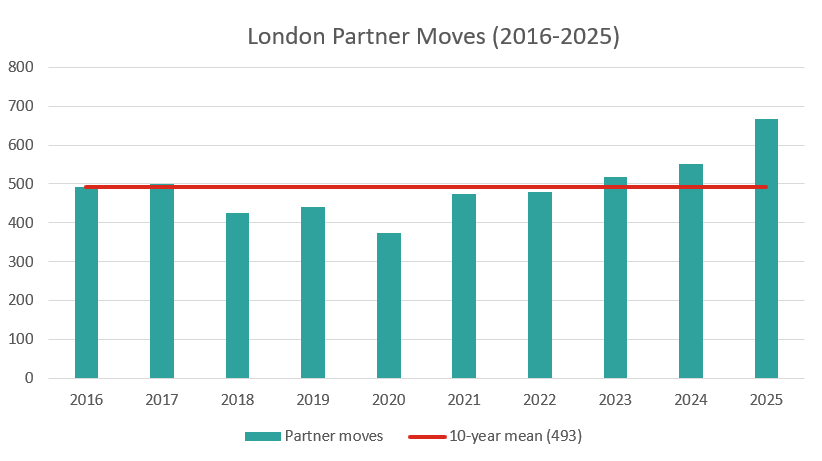

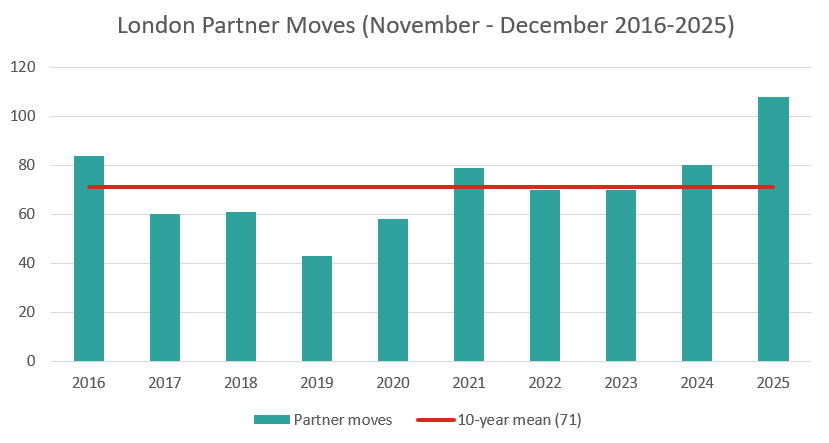

Figure note: The ten-year rolling graph shows the (then) record years for partner hiring - 2016 and 2017 – these were both significantly higher than any previous years up to that point, due to the market shock created by the collapse of KWM Europe (at the time a Top 20 law firm) in December 2016. Post-covid law firm partner hiring has seen “real term” record hiring every single year, with the last three-years showing exponential acceleration.

Figure note: The ten-year rolling graph shows the (then) record years for partner hiring - 2016 and 2017 – these were both significantly higher than any previous years up to that point, due to the market shock created by the collapse of KWM Europe (at the time a Top 20 law firm) in December 2016. Post-covid law firm partner hiring has seen “real term” record hiring every single year, with the last three-years showing exponential acceleration.

As is often the case in our year-end edition, the most acquisitive firm of the year was Kirkland & Ellis which, aided by its scale and “up-or-out” partnership structure, hired 19 partners (albeit only 5 were laterals). Next up was: Addleshaw Goddard, Baker McKenzie, Fladgate and White & Case which snapped up 14, (with nine of the Fladgate joiners being émigrés from the collapsed Memery Crystal); then Charles Russell Speechlys which hired 12 partners.

- Top partner recruiters in London 2025

|

Top partner recruiters in London 2025 |

Total hires |

Lateral hires |

|

Kirkland & Ellis |

19 |

5 |

|

Addleshaw Goddard |

14 |

9 |

|

Baker McKenzie |

14 |

12 |

|

Fladgate |

14 |

14 |

|

White & Case |

14 |

8 |

|

Charles Russell Speechlys |

12 |

7 |

|

Proskauer |

11 |

7 |

|

Simmons & Simmons |

11 |

9 |

|

DLA Piper |

10 |

9 |

|

Eversheds Sutherland |

10 |

5 |

|

Jones Day |

10 |

9 |

|

Shoosmiths |

10 |

8 |

|

Stephenson Harwood |

10 |

8 |

|

DWF |

9 |

7 |

|

Gibson Dunn |

9 |

8 |

|

Paul Hastings |

9 |

8 |

|

Paul Weiss |

9 |

7 |

|

Pinsent Masons |

9 |

9 |

|

Squire Patton Boggs |

9 |

6 |

- Top partner recruiters in London 2025 (partnership to partnership moves only)

|

Top partner recruiters in London 2025 |

Lateral hires |

|

Fladgate |

14 |

|

Baker McKenzie |

12 |

|

Addleshaw Goddard |

9 |

|

DLA Piper |

9 |

|

Jones Day |

9 |

|

Pinsent Masons |

9 |

|

Simmons & Simmons |

9 |

|

Gibson Dunn |

8 |

|

Latham & Watkins |

8 |

|

Paul Hastings |

8 |

|

Shoosmiths |

8 |

|

White & Case |

8 |

- Team hires 2025

The most sizeable multi-partner team move in 2025 was Fladgate’s rescue of a mixed nine-partner corporate, finance and real estate team from (the now defunct) Memery Crystal in February. Followed by DWF which swiped a quintet of shipping/marine laterals from Kennedys. Meanwhile, three firms hired four-partner teams: Haynes Boone (corporate) from Memery Crystal; Milbank (infrastructure) from White & Case; and Orrick (CLOs and structured finance) from Cadwalader.

In addition, seven firms hired three-partner teams: Freshfields (energy & infrastructure from Paul Hastings); Goodwin (private equity from Paul Hastings); Joseph Hage Aaronson & Bremen (construction disputes from Quinn Emanuel); Mayer Brown (private capital from Dechert); Pinsent Masons (IP from Deloitte Legal); Sidley Austin (private funds from Weil); and White & Case (IP from A&O Shearman* as well as a separate three-partner private equity team from Ropes & Gray).

* Including one vertical move from A&O Shearman’s Belfast office.

A&O Shearman and Paul Hastings suffered the highest attrition in 2025 – losing 19 serving partners to rivals – followed closely by the collapsing (and now defunct) Memery Crystal which lost 18, and Kirkland & Ellis and White & Case both losing 15.

- Firms with largest attrition in 2025 (partnership to partnership moves only)

|

Highest partner attrition |

No. laterals lost |

|

A&O Shearman |

19** |

|

Paul Hastings |

19 |

|

Memery Crystal |

18 |

|

Kirkland & Ellis |

15 |

|

White & Case |

15 |

|

DLA Piper |

11 |

|

Kennedys |

10 |

|

Ashurst |

9 |

|

Dechert |

9 |

|

Goodwin |

9 |

|

Eversheds Sutherland |

8 |

|

EY Law |

8 |

|

Stephenson Harwood |

8 |

** Excludes a lateral move from A&O Shearman (Singapore) to Osborne Clarke in London.

- What’s behind the escalating three-year bull run in Law Firm Partner Hires in London, and is it sustainable?

At first glance it seems puzzling that, despite the UK’s lacklustre economy lLaw firm partner hiring has accelerated sharply over the past three years, defying the broader economic drag. The reasons for this seeming paradox are both cyclical and structural.

(i) Size matters – the need for scale

Even prior to the rise of generative AI, at the top, Big Law leadership has seen scale—built through organic growth and, frequently, mergers—as critical to winning complex cross border mandates and obtaining (or sustaining) “Global Elite” positioning. The advent of generative AI has catalysed this, reinforcing the view that significant spending on technology and data is now table stakes. To fund this while preserving profitability, upper quartile firms have continued to bulk up and, in parallel, prune lower margin or conflict heavy practices. The result is more concentrated demand for high end partners and intensified movement at the top, while simultaneously creating attractive “cast off” opportunities for firms further down the pecking order to acquire perfectly profitable (albeit lower margin) practices. A version of that same process has been playing out, mutatis mutandis, in the mid-tier.

(ii) Law firm’s sustained bets on private‑capital hires

Edwards Gibson has previously stressed the outsized impact of US law firms pumping hundreds of millions of dollars into London on private capital related investment hires. Despite private equity market fundamentals being comparatively weak, in 2025 US law firms (and many UK rivals) remained locked in this private capital arms race, which continued to fund partner compensation and team build outs. This wave, which has been supercharged since 2023 – has proved remarkably resilient with law firms both doubling down and finding new, relatively under-lawyered, areas for growth. For example, 2025 has seen once niche, sub-sectors, such as private equity real estate (PERE), increase from just one partner hire in 2021, to 15 partners in 2025.

(iii) Partnership model shifts at elite US firms

Over the past three years, formerly all‑equity US firms have widely adopted two‑tier—or otherwise more flexible—partnership models. This has made it much easier for those firms to both hire day-one partners, and to stretch equity to lure rainmakers in London. That same flexibility can also be a push-factor for “lifers” (including non-partners moving for day one partnership elsewhere) who have seen the DNA of their “forever firm” changing, thus loosening their institutional loyalty and increasing churn.

(iv) English law’s gravitational pull makes London a private capital deals hub

Regardless of the UK’s domestic economy, London’s role as the world’s second largest law market rests on English law’s gravitational pull for global deals. US private capital has reinforced the centrality of the New York–London axis with US firms rarely investing for UK domestic work alone; rather they are scaling City benches to serve the world’s biggest funds and corporates transacting under English law.

(v) Litigation funders – Class act(s)?

The rise of funding and group actions has added oxygen to contentious hiring. While funding cycles track private equity style capital and interest rates, legal changes—unless reversed—may also have begun to entrench a larger structural demand for disputes partners. The UK’s collective actions regime (especially in the Competition Appeal Tribunal [CAT]) and the maturation, and potential reform, of third-party funding continue to expand the active docket, even as courts scrutinise funder terms and class representation more closely. 2024–2025 saw milestone settlements and judgements, a busier CAT calendar, and policy attention via the Civil Justice Council’s review of litigation funding—all of which have sustained demand for senior contentious talent in competition, securities and ESG adjacent claims.

(vi) Disruption and instability

All of the above is causing disruption. As platforms reconfigure (often linked to consolidation and profitability drives), partner mobility spikes—even within otherwise steady practice areas. When firms merge, partner attrition typically rises before and after the coupling as practice overlaps, client conflicts, partner egos and relative‑contribution issues play out. For example, in 2025 recently merged A&O Shearman recorded the joint highest number of lateral departures – nearly 3% of all moves. Once-rare law firm collapses, for example the demise of Axiom Ince (2023) and Memery Crystal (2025), dumped dozens of hapless partners into the market whose scramble to find new homes has been reflected in the figures. Elsewhere, strategy resets—such as the Big Four accounting firms’ (almost) wholesale retreat from Big Law—have had similar effects. Ironically, by instigating many of these changes the perceived beneficiaries of this Big Law tumult—super-elite US law firms with outsized profits—have, unwittingly undermined their own structural stability and may themselves eventually become the most high-profile victims of the very disruptive forces they have helped to unleash.

Can this bull run last? - our view on sustainability

Short answer: no—not at the current rate. The cyclical tailwinds (private‑capital surges, funding cycles, disruption bursts) will ebb. At the top there are only so many star private equity, debt finance and private funds teams left who have not moved, or can move again. Moreover, beyond a small cadre of super-elite law firms, the economics of star hires is difficult to justify. But several structural factors—tech/data investment needs, consolidation, and flexible partnership architecture—should keep London’s run‑rate above 10‑year averages in the short term, even if hiring moderates into a higher plateau rather than another year of record acceleration.

What is not (yet) moving the dial

Private equity investment into law firms themselves has, so far, had only a limited and not yet measurable impact on partner move volumes in London. If it catalyses further structural change — and with top 20 global firms like McDermott Will & Schulte seemingly giving the model serious consideration, it is clearly something Big Law cannot completely ignore — we would expect that to feed through in future years.

- Merger Movers - Big Law Year End Tie-Ups

Ever since Clifford Chance merged with New York firm Rogers & Wells back in 2000, legal commentators have predicted a wave of transatlantic law firm mergers. However, while there have certainly been a handful of high profile tie ups over the years, most took the form of verein like combinations (i.e., they did not share a single global profit pool) — which some critics say is akin to cheating.

Then, last year, Allen & Overy hitched up with Shearman & Sterling to form A&O Shearman and, earlier this year, Herbert Smith Freehills and Kramer Levin followed suit to create Herbert Smith Freehills Kramer. Suddenly, the last two months of 2025 saw the announcement of three more transatlantic tie ups in quick succession:

• Ashurst with Perkins Coie to form Ashurst Perkins Coie;

• Winston & Strawn with (most of) Taylor Wessing to form Winston Taylor; and

• Hogan Lovells with Cadwalader Wickersham & Taft to form Hogan Lovells Cadwalader.

This suggests that the quarter century old prophecy may finally be coming to pass. Significantly, if approved, all five of the merged entities will operate as fully integrated global partnerships with single profit pools. So too will the product of Big Law’s other notable merger this year — McDermott Will & Shulte — which, although not “transatlantic” (as it involved two US headquartered firms), nevertheless integrated the London offices of its legacy firms McDermott Will & Emery and Schulte Roth & Zabel.

2025 saw recently merged A&O Shearman suffer the joint highest attrition figures of any firm in London – 19 partners - (12 from legacy Allen & Overy and 7 from legacy Shearman & Sterling).

The reason law firm combinations are so often followed by spikes in partner moves is that mergers typically trigger elevated partner attrition (some planned) — both immediately before and after the coupling — as practice overlaps, client conflicts, partner egos, and issues around relative contribution almost always come into play. These pressures become exponentially greater when the proposed combination involves a fully integrated partnership with a single profit pool and, where shared geography requires legacy offices to physically integrate.

Indeed, 2025 saw newly merged A&O Shearman suffer the joint highest attrition figures of any firm in London: 19 partners (12 from legacy Allen & Overy and 7 from legacy Shearman & Sterling). Notwithstanding A&O Shearman’s public commitment to trim its global partnership by 10% in post merger cuts, Edwards Gibson estimates that the firm would probably have preferred to retain all but four or five of those who departed (i.e., between 75%–80%).

— the current wave of transatlantic tie ups is unprecedented in scope and, given the shift to fully integrated partnerships with single global profit pools (and, in most instances, physical office integration), will inevitably produce more merger driven partner moves in aggregate.

As far as London goes, whilst the merits and challenges of each of the combinations mentioned above vary widely — and some firms will experience far greater disruption than others — the current wave of transatlantic tie ups is unprecedented in scope and, given the shift to fully integrated partnerships with single global profit pools (and, in most instances, physical office integration), will inevitably produce more merger driven partner moves in aggregate. To the extent this occurs, the figures will, of course, be captured in future editions of Edwards Gibson’s Partner Moves in London.

- Poor Hastings

Although A&O Shearman and Paul Hastings suffered the joint highest rate of attrition (both losing 19 partners to rivals), due to its much smaller London office, the hit to Paul Hastings was proportionally far greater with the Los Angeles spawned firm losing more than a third of its London line-up from the start of the year***.

The departures comprised no fewer than five separate teams as well as a number of individuals, some of whom had global or departmental management responsibilities including: the Global Second Managing Partner and Vice Chair of International Tax; the Global Co-Chair of Corporate; the European Head of Funds; the European Head of Real Estate; and most recently, the Vice Chair of Global Private Equity and Head of London Private Equity.

Against this, the firm has made 9 partner hires in London (eight laterals and one vertical), over half of whom joined the firm in the last two months of the year (see full write up below).

*** According to The Lawyer, Paul Hastings had 56 partners in London in 2024.

- Genesis and Exodus – one US law firm launches whilst another flees London

Over the summer Los Angeles headquartered full-service law firm Michelman Robinson launched a London office (which for some reason only became official in October) and, so far, has hired 5 corporate crime and disputes partners. The firm, which falls outside of the AmLaw 200, is a comparative minnow by Big Law standards. Nevertheless, despite having fewer than 40 partners at launch, it boasts 7 Stateside offices.

By contrast, in January the Kansas-headquartered firm Shook, Hardy & Bacon announced the closure of its London office. As part of this realignment, the firm's two managing partners transitioned to CMS, bolstering that firm's contentious product liability practice. Never large, the reasonably obscure disputes focused US firm was once known for big-ticket tobacco litigation and, along with (now defunct) LeBoeuf, Lamb, Greene & MacRae, for having the most carnivorous sounding name in town.

- Memery Loss - the collapse of a storied London firm also elevated the 2025 figures

In a further blow to the listed law firm model, RBG Holdings, the parent company of London firm Memery Crystal, and disputes boutique Rosenblatt, collapsed. This followed a period of intense speculation and various attempts to source funds. Whilst the eponymous Ian Rosenblatt managed to regain control of his former firm (which, then successfully separated from RBG Holdings as Rosenblatt Law Limited), unfortunately, the near 50-year-old storied commercial law firm Memery Crystal did not survive the tumult.

Of its 35 partners, pre-collapse, Edwards Gibson has tracked 26 to new homes although, in accordance with our methodology, only 18 of these lateral émigrés qualified for inclusion in our bi-monthly reports which recorded moves to: Blake Morgan (one partner); Edwin Coe (two partners), Fladgate (nine partners), and Haynes Boone (five partners).

In addition, life rafts were provided by Lawrence Stephens (which took a four-partner real estate team who joined as non-partners) and alternative law firm Keystone Law which also welcomed four.

- Alternative Law Firms

As per our methodology, Edwards Gibson only records hires by law firms with conventional partnership (or corporate) structures. As such, we do not record hires to “alternative law firms”; the way they are structured, and the difficulties in confirming a given lawyer’s location at these entities, make like-for-like comparisons with conventional law firms challenging. Nevertheless, it should be noted that were we to do so, Keystone Law would likely feature at the top of the rankings above - on a rough reckoning, Keystone Law welcomed 33 relevant partners in 2025.

- Other Fun Facts in 2025

• 31% of moves this year were female (205) – over the past five years this figure has ranged from 26% to 32%.

• 5% of all hires (34) were from in-house or business.

• 21% of all moves (141) were vertical promotions (non-partnership law firm roles to partnership upon moving to another law firm).

- November – December 2025

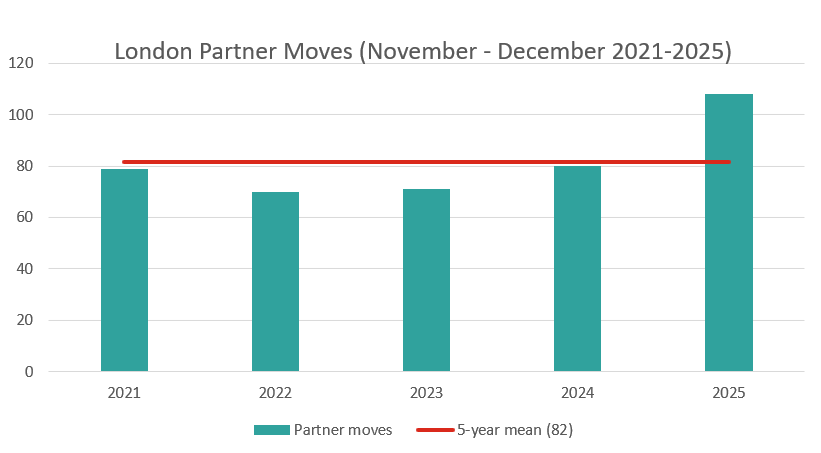

This bi-monthly round-up contains 108 partner moves, which is 35% up on the 80 we saw for the same period last year; 32% up on the cumulative five-year average (82); and 51% up on the cumulative ten-year average of (71) for the same period.

The number comfortably exceeds the previous record for the same period (84) set in 2016 following the collapse of KWM Europe (at the time a Top 20 law firm) in December of that year.

The most covetous firms this edition were Addleshaw Goddard, Baker McKenzie and Paul Hastings, which each hired 5 partners. They were followed by DLA Piper, Goodwin, Hill Dickinson, and Kirkland & Ellis which all hired 4 apiece; then Charles Russell Speechlys, Eversheds Sutherland and Simons Muirhead Burton, which hired 3 partners each.

- Top partner recruiters in London November – December 2025

|

Addleshaw Goddard |

5 |

(3 laterals) |

|

Baker McKenzie |

5 |

(3 laterals) |

|

Paul Hastings |

5 |

(5 lateral) |

|

DLA Piper |

4 |

(4 laterals) |

|

Goodwn |

4 |

(4 laterals) |

|

Hill Dickinson |

4 |

(3 laterals) |

|

Kirkland & Ellis |

4 |

(1 lateral) |

|

Charles Russell Speechlys |

3 |

(2 laterals) |

|

Eversheds Sutherland |

3 |

(3 laterals) |

|

Simons Muirhead Burton |

3 |

(0 laterals) |

In addition, 12 firms hired 2 partners each: Akin Gump, Baker Botts, Browne Jacobson, Hamlins, Jones Day, McDermott Will & Schulte, Morrison Foerster, Pillsbury, Proskauer, Reed Smith, Sullivan & Cromwell and Trowers & Hamlins.

On the other side of the coin, following its recently announced merger, Ashurst suffered the highest attrition over the same period, losing 4 lateral partners in London, followed by DLA Piper, Kirkland & Ellis, Morrison Foerster and Paul Hastings each losing 3 partners.

- Firms with largest attrition in November – December 2025 (partnership to partnership moves only)

|

Ashurst |

4 |

|

DLA Piper |

3 |

|

Kirkland & Ellis |

3 |

|

Morrison Foerster |

3 |

|

Paul Hastings |

3 |

- Team hires November – December 2025

The most sizeable multi-partner team move this round-up was Goodwin’s hire of a corporate private equity trio from Paul Hastings which included the firm’s Vice Chair of Global Private Equity and Head of London Private Equity.

In addition, six firms hired two-partner teams: Akin Gump (private equity from Ropes & Gray); Baker Botts (projects and energy from Vinson & Elkins); Baker McKenzie (equity capital markets from Ashurst); Eversheds Sutherland (corporate insurance and tax from DLA Piper); Jones Day (project finance from Gowling WLG); and Sullivan & Cromwell (private equity and tax from Kirkland & Ellis).

- Other Fun Facts November – December 2025

• 31% of moves this edition were female (34).

• 7 firms hired from in-house or business: Addleshaw Goddard (from Patron Capital), Baker McKenzie (from Citibank), Browne Jacobson (from Barclays); Mishcon de Reya (from Deloitte), Reed Smith (from Leicester City F.C.), Simons Muirhead Burton (from The Akuna Group and the Serious Fraud Office) and Ropes & Gray (from EQT).

• 34% of all moves (37) were moves from non-partnership roles (either moves from in-house or non-partners elevated to partnership upon moving from another law firm).

CLICK THE DOWNLOAD LINK BELOW FOR OUR FULL NOVEMBER - DECEMBER 2025 REPORT

Please do not hesitate to contact us if you would like to discuss this article or any other aspect of the market in more depth.

Scott Gibson, Director scott.gibson@edwardsgibson.com or +44 (0)7788 454 080

Sloane Poulton, Director sloane.poulton@edwardsgibson.com or +44 (0)7967 603 402

Please click here to understand our methodology for compiling Partner Moves

Download the full Partner Moves Issue here >>

If you would like to subscribe to our Partner Moves Newsletter, email us at support@edwardsgibson.com

Edwards Gibson Partner Round-Up - Our Methodology

Edwards Gibson Partner Round-Up - Our Methodology Previous editions of Partner Moves in London

Previous editions of Partner Moves in London Quantifying your following and writing an effective law firm business plan

Quantifying your following and writing an effective law firm business plan Specimen partner business plan template

Specimen partner business plan template The Partnership Track and Moving for Immediate Partnership

The Partnership Track and Moving for Immediate Partnership Legal directory rankings and their effect on lawyer recruitment

Legal directory rankings and their effect on lawyer recruitment Restrictive Covenants and Moving on as a Partner

Restrictive Covenants and Moving on as a Partner

What’s behind the escalating three-year bull run in Big Law Partner Hires in London and is it sustainable?

What’s behind the escalating three-year bull run in Big Law Partner Hires in London and is it sustainable?  Year End Big Law Tie Ups - and the standout is Hogan Lovells Cadwalader

Year End Big Law Tie Ups - and the standout is Hogan Lovells Cadwalader “To: Cc or not Cc” – Clifford Chance's subversive new branding

“To: Cc or not Cc” – Clifford Chance's subversive new branding  Two Big Law Summer Weddings … and an Anniversary

Two Big Law Summer Weddings … and an Anniversary Freshfields’ Non-Share Home Turf Handicap

Freshfields’ Non-Share Home Turf Handicap Big Law Jenga: How Private Capital Stars Are Making Elite Firms Unstable

Big Law Jenga: How Private Capital Stars Are Making Elite Firms Unstable Big Law’s Brave “Few”, Their Inevitable Pyrrhic Victory, and Why This Is Still a Tragedy for The Rule of Law

Big Law’s Brave “Few”, Their Inevitable Pyrrhic Victory, and Why This Is Still a Tragedy for The Rule of Law No Accounting for the Big Four in Big Law

No Accounting for the Big Four in Big Law