Download the full Partner Moves Issue here >>

Welcome to the 78th edition of Law Firm Partner Moves in London, from the specialist partner team at Edwards Gibson, where we look back at announced partner-level recruitment activity in London over the past two months and give you a ‘who’s moved where’ update. This edition concludes our Law Firm Partner Moves in London for 2023 and we have included some facts and figures below comparing this year’s partner-level recruitment activity with that over the past ten years.

- A summary of 2023

There were 510 partner moves announced in 2023 which is the highest number ever recorded in a single year - 6% up on the 480 we saw in 2022, and 12% and 13% up on the five and ten-year averages respectively. Our records go back to 2007 and, despite a relatively soft market for legal services, the partner hire market has been fueled by an odd mixture of (sometimes dramatic) countercyclical investments by US law firms in private equity related hires, alongside voluntary or involuntary partner moves resulting from perceived or actual structural failings at individual law firms.

Moves prompted by perceived structural failings included highly marketable partners at excellent, albeit a tad diminished, brands such as (pre-merger) Shearman & Sterling, jumping to more profitable homes to avoid, at best, the negative impact on their compensation from their firm’s relative underperformance or, at worst, a “run on the partnership”. Easier to measure was the impact of the collapse, or closure, of individual law firms - most notably national firm Axiom Ince and its antecedents whose often hapless alumni, together with those from three other law firms which closed their doors, collectively constituted 8% of all moves recorded this year.

The number of hires this year breaks the previous record of 501 set in 2017; a year which was itself disproportionally elevated due to the collapse of KWM’s European verein. As such, it is perhaps fitting that this year’s figures were also boosted (albeit by a modest 1%) by the final closure of KWM (China)’s EMEA and South America verein.

The most acquisitive firm of 2023 was Kirkland & Ellis which - aided in part by its unusual partnership structure - hired 18 partners (albeit only 8 were laterals) succeeded by Paul Weiss, which snapped up 14 partners (all laterals), then Addleshaw Goddard 13 partner hires (9 laterals).

- Top partner recruiters in London 2023

| Top partner recruiters in London 2023 | Total hires | Lateral hires |

| Kirkland & Ellis | 18 | 8 |

| Paul Weiss | 14 | 14 |

| Addleshaw Goddard | 13 | 9 |

| Stephenson Harwood | 11 | 7 |

| CMS Cameron McKenna | 10 | 7 |

| Howard Kennedy | 10 | 7 |

| Paul Hastings | 10 | 6 |

| Eversheds Sutherland | 10 | 9 |

| Irwin Mitchell | 8 | 8 |

| Ashurst | 7 | 4 |

| DWF | 7 | 3 |

| Hill Dickinson | 7 | 7 |

| Latham & Watkins | 7 | 6 |

| Pinsent Masons | 7 | 5 |

| Watson Farley & Williams | 7 | 5 |

- Top partner recruiters in London 2023 (partnership to partnership moves only)

| Top partner recruiters in London 2023 | Lateral hires | |

| Paul Weiss | 14 | |

| Addleshaw Goddard | 9 | |

| Eversheds Sutherland | 9 | |

| Irwin Mitchell | 8 | |

| Kirkland & Ellis | 8 | |

| CMS Cameron McKenna | 7 | |

| Hill Dickinson | 7 | |

| Howard Kennedy | 7 | |

| Stephenson Harwood | 7 |

Besides Axiom Ince (which collapsed), Kirkland & Ellis suffered the highest attrition, losing 18 serving partners to rivals, followed by Linklaters - which lost 12 - and Shearman & Sterling, which parted ways with 11.

- Firms with highest attrition in London 2023 (partnership to partnership moves only)

| Highest partner attrition | No. laterals lost |

| Axiom Ince | 27* |

| Kirkland & Ellis | 18 |

| Linklaters | 12 |

| Shearman & Sterling | 11 |

| Travers Smith | 10 |

| Norton Rose Fulbright | 9 |

| Bryan Cave Leighton Paisner | 8 |

| Mishcon de Reya | 8 |

| Dickson Minto | 7 |

| MJ Hudson | 7 |

| Pinsent Masons | 7 |

| Reed Smith | 7 |

| White & Case | 7 |

*"Axiom Ince" covers all lateral departures from Axiom Ince, Ince and Plexus Law this year. As per below, only moves made in accordance with our methodology are listed.

By far the most significant event in BigLaw in 2023 was the formation of A&O Shearman - a merger between UK magic circle firm Allen & Overy and white shoe New York outfit Shearman & Sterling to create a true legal leviathan with revenues of $3.4 billion. Prior to the announcement of the pending tie-up in March, Shearman had seen an increasing flow of lateral departures across Europe and the Middle East (with the latter virtually emptied of partners). In London at least, the merger (which was voted through in October) coincided with a slowdown in partner attrition; of the 11 laterals who decamped from the New York firm in London in 2023, only two did so in the second half of the year.

The second most significant event in BigLaw, at least in the UK, was the re-launch of New York law firm Paul Weiss’ London office with a largely English law offering. The fiery re-birth was overwhelmingly at the expense of its Chicago rival Kirkland & Ellis, from whom it has so far ripped no fewer than 10 laterals - including legal rockstars Neel Sachdev and Roger Johnson - since August in London alone**. Nevertheless, as if to show it has nothing personal against its Chicago rival, the Wall Street firm also snatched two partners from Linklaters and two from Clifford Chance, bringing its total haul of London laterals to an astonishing 14.

**In a (likely) related move, Paul Weiss also hired 4 laterals from Kirkland & Ellis in New York and Los Angeles.

- Team Hires

The most significant team hire of 2023 was Paul Weiss’ 10-partner raid on Kirkland & Ellis (see above) followed by Milbank’s acquisition of a 6-partner private equity and antitrust team from clandestine Scottish private equity boutique Dickson Minto. Whilst it was announced at the end of last year that most of the London office of Dickson Minto was to defect to Milbank (reported in our 72nd Edition), the final line up of arrivals was not confirmed until their appearance at Milbank in March 2023.

The other most sizable team hires were: Eversheds Sutherland’s opportunistic acquisition of a five-partner mixed corporate and disputes offering as a result of KWM (China)’s disposal of its entire EMEA and South America verein; Kirkland & Ellis’ own raid on its nemesis Paul Weiss for a five-partner (two laterals and three verticals) US qualified private equity and M&A team*** and Collyer Bristow’s snatching of a four-partner team (three laterals and one vertical) from the collapsed Axiom Ince.

In addition, the following firms all hired three partner teams: Haynes and Boone - corporate and funds/financial services - from MJ Hudson (all laterals); Hunton Andrews Kurth - disputes and energy and infrastructure - from Clyde & Co (all laterals); Kirkland & Ellis - finance - from Simpson Thacher (two laterals and one vertical); and Simpson Thacher - funds/financial services - from Travers Smith (all laterals).

***This team hire was originally reported in August as a four-partner (two laterals and two verticals) move.

- Constructive Destruction – “Ince and Out”

Fuelling the lateral market this year was the collapse of Axiom Ince, a national law firm with 100-plus partners and a penchant for acquiring other failed firms, which shut down amidst allegations of impropriety and fraud in October.

In its final form, Axiom Ince only technically existed for five months. However, many partners moved from the amalgamation of its predecessor firms throughout 2023. As we cannot be certain as to how many partners left prior to the creation of Axiom Ince (since partner moves are often reported later than their actual occurrence), we have recorded all lateral moves from the organisations “rescued” by the now-defunct outfit this year (notably Ince & Co, Gordon Dadds and Plexus Law) as moves from Axiom Ince.

In accordance with our methodology, Edwards Gibson has not recorded all the announced moves by Axiom Ince émigrés. This is because they either work in practice areas that we do not record, or because, despite assertions to the contrary, in our assessment, the partners are not in fact based in London. One particularly high-profile team move, comprising seven Axiom Ince insurance and shipping partners joining Norwegian firm Wikborg Rein - which was significant enough to be included in The Lawyer Top 10 Moves of 2023 - was not recorded in our publication because none of the departing lawyers joined their new firm as partners. Nevertheless, 27 moves (approximately 5% of all partner hires in 2023) were as a direct result of the collapse of Axiom Ince or its precursors.

- Bringing Closure …

Other law firm closures which boosted lateral hires at other firms this year included the collapse of the legal services arm of funds boutique MJ Hudson (7 partners); KWM (China)’s disposal of its entire EMEA and South America verein (5 partners) and the closure of the dwindling London office of New York firm Constantine Cannon (3 partners).

- The Travails of Travers Smith

Throughout 2023 we reported on the high attrition at Travers Smith which lost laterals to: Freshfields; Fieldfisher; Dechert; Linklaters; Simpson Thacher & Bartlett (4 partners); White & Case and Cleary Gottlieb. Ignoring promotions, the 80 something partner private equity focused firm lost over 12% of its partnership to competitors – 10 partners in all – which, alongside the two partners that it lost at the end of 2022, at the half year mark made it look in danger of suffering a run on the partnership. Happily, the firm lost only two laterals in the second half of the year.

- Private Equity, that gift that keeps giving to BigLaw …

Despite high global interest rates dampening that more than decade long dynamo of BigLaw - private equity - plenty of law firms made significant investment bets in the expectation of a market Renaissance in leveraged finance, corporate finance, M&A and private fund formation****. More pressingly, increased borrowing costs also hiked the demand for private credit, restructuring and special situations lawyers. Aside from Paul Weiss and the usual suspects - Kirkland & Ellis and Latham & Watkins - Paul Hastings and Milbank also bet big on private equity and so did many other US law firms, whose demand for partner talent extended beyond the usual law firm vs law firm talent war to in-house targets, which were often clients, including: Fairview Partners (Paul Hastings); Permira (Ropes & Gray); KKR (Paul Hastings); Blackstone (Simpson Thacher) and Strategic Value Partners (Sidley Austin). Of particular note was New York elite Cravath, Swaine & Moore’s launching an English law practice with a two-partner leveraged finance team from Shearman & Sterling in March.

****It has been widely reported that, at least three of the individual partners who moved to Paul Weiss and Kirkland & Ellis, were paid annual compensation of c.$20 million each.

- The (Magic) Circle of Recruitment

In our round-up last year we commented on the record number of hires made by magic circle law firms (21) vs a more typical run rate of between 4 and 8 partners in London per annum. Once again, the magic circle was very active, hiring a total of 18 partners (16 laterals) - the second highest number on record - in the following order: Clifford Chance (3); Freshfields (4) Allen & Overy (5) and Linklaters (6).

Whilst the magic circle may have become more covetous, collectively it lost 19 serving partners to other (overwhelmingly US) firms, with Linklaters alone losing 12 laterals (at least 9 of whom it would probably have preferred to keep!). That being said, with A&O Shearman going live next year, and with some in the magic circle - notably Freshfields - actively eschewing the term and preferring instead “global elite”, the moniker “Magic Circle” is perhaps on borrowed time.

- Alternative Law Firms

As per our methodology, Edwards Gibson only records hires by law firms with conventional partnership (or corporate) structures. As such, we do not record hires to “alternative law firms”; the way they are structured, and the difficulties in confirming a given lawyer’s location at these entities, make like-for-like comparisons with conventional law firms challenging. Nevertheless, it should be noted that were we to do so, Keystone Law would likely feature at the top of the rankings above - on a rough reckoning, Keystone hired 24 relevant partners in 2023.

- Other Fun Facts From 2023

- 31% of moves (157) were female - over the past 5 years this figure has ranged between 26% to 32%.

- 5% of all moves (26) were in-house lawyers moving into law firm partnership.

- Including those moving from in-house, 124 lawyers (24%) moved from non-partner roles into partnership.

- November – December 2023

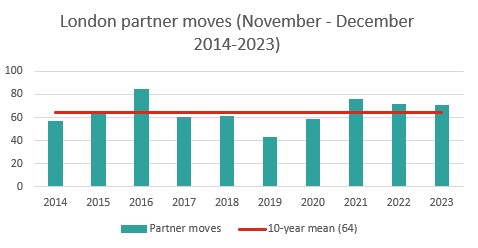

This bi-monthly round-up contains 70 moves, just missing the 71 we saw for the same period last year but comfortably ahead of the cumulative five-year and ten-year averages for the same period - 64 for both.

- Top partner recruiters in London November – December 2023

| Eversheds Sutherland | 6 | (6 laterals) |

| Paul Weiss | 4 | (4 laterals) |

| Addleshaw Goddard | 3 | (2 laterals) |

| Kirkland & Ellis | 3 | (2 laterals) |

| Latham & Watkins |

3 | (3 laterals) |

3 firms hired from in-house in November and December of 2023: Blake Morgan (from BNP Paribas); Paul Hastings (from KKR) and Ropes & Gray (from Permira).

- Market Outlook

Throughout 2023 law firms continued to bet heavily on the expectation that inflation, and therefore global interest rate hikes, would prove temporary and that their inevitable fall would presage a return to private equity led deal making. These partner-led investment hires, whereby law firms essentially bought future books of business, were in stark contrast to the recruitment market for junior lawyers which more accurately reflected the softer “real time” demand for transactional legal services - decreasing sharply and reversing the recruitment spree which followed the post-pandemic dealmaking boom. At the time of writing, many departments remain underutilised yet reluctant to downsize hopeful of a market uptick. So far only a handful of teams, predominately in commercial real estate, have commenced formal redundancy rounds, although without a market pick-up that trend will likely accelerate.

Global inflation has now begun to fall and, although interest rates have yet to follow, even if they do, it will take some time for that to feedthrough to BigLaw which, notwithstanding its record number of partner hires this year, saw profitability fall in FY 2022/23. Despite being naturally hedged with disputes and restructuring offerings, London’s BigLaw firms remain overwhelmingly transactionally focused and will continue to face strong challenges from an uncertain economy in 2024 which, let’s not forget, is also an election year on both sides of the Atlantic.

Please do not hesitate to contact us if you would like to discuss this article or any other aspect of the market in more depth.

Scott Gibson, Director scott.gibson@edwardsgibson.com

or +44 (0)7788 454 080

Sloane Poulton, Director sloane.poulton@edwardsgibson.com

or +44 (0)7967 603 402

Please click here to understand our methodology for compiling Partner Moves

Download the full Partner Moves Issue here >>

If you would like to subscribe to our Partner Moves Newsletter, email us at support@edwardsgibson.com

Edwards Gibson Partner Round-Up - Our Methodology

Edwards Gibson Partner Round-Up - Our Methodology Previous editions of Partner Moves in London

Previous editions of Partner Moves in London Quantifying your following and writing an effective law firm business plan

Quantifying your following and writing an effective law firm business plan Specimen partner business plan template

Specimen partner business plan template The Partnership Track and Moving for Immediate Partnership

The Partnership Track and Moving for Immediate Partnership Legal directory rankings and their effect on lawyer recruitment

Legal directory rankings and their effect on lawyer recruitment Restrictive Covenants and Moving on as a Partner

Restrictive Covenants and Moving on as a Partner

What’s behind the escalating three-year bull run in Big Law Partner Hires in London and is it sustainable?

What’s behind the escalating three-year bull run in Big Law Partner Hires in London and is it sustainable?  Year End Big Law Tie Ups - and the standout is Hogan Lovells Cadwalader

Year End Big Law Tie Ups - and the standout is Hogan Lovells Cadwalader “To: Cc or not Cc” – Clifford Chance's subversive new branding

“To: Cc or not Cc” – Clifford Chance's subversive new branding  Two Big Law Summer Weddings … and an Anniversary

Two Big Law Summer Weddings … and an Anniversary Freshfields’ Non-Share Home Turf Handicap

Freshfields’ Non-Share Home Turf Handicap Big Law Jenga: How Private Capital Stars Are Making Elite Firms Unstable

Big Law Jenga: How Private Capital Stars Are Making Elite Firms Unstable Big Law’s Brave “Few”, Their Inevitable Pyrrhic Victory, and Why This Is Still a Tragedy for The Rule of Law

Big Law’s Brave “Few”, Their Inevitable Pyrrhic Victory, and Why This Is Still a Tragedy for The Rule of Law No Accounting for the Big Four in Big Law

No Accounting for the Big Four in Big Law