Download the full Partner Moves Issue here >>

Welcome to the 66th edition of law firm partner moves, from the specialist partner team at Edwards Gibson, where we look back at announced partner-level recruitment activity in London over the past two months and give you a ‘who’s moved where’ update.

This edition concludes our Law Firm Partner Moves in London for 2021 and we have included some facts and figures below comparing this year’s partner-level recruitment activity with that over the past ten years.

A summary of 2021

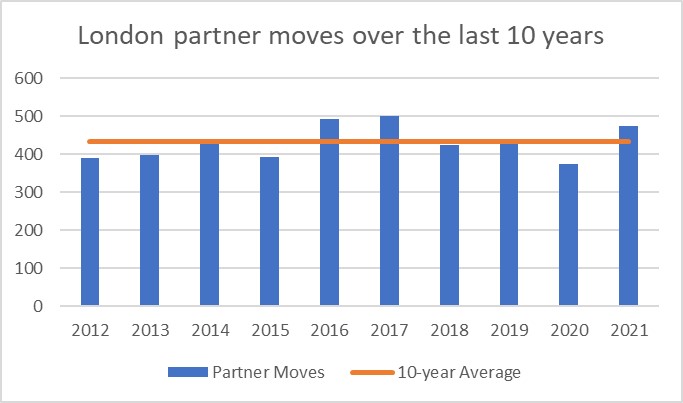

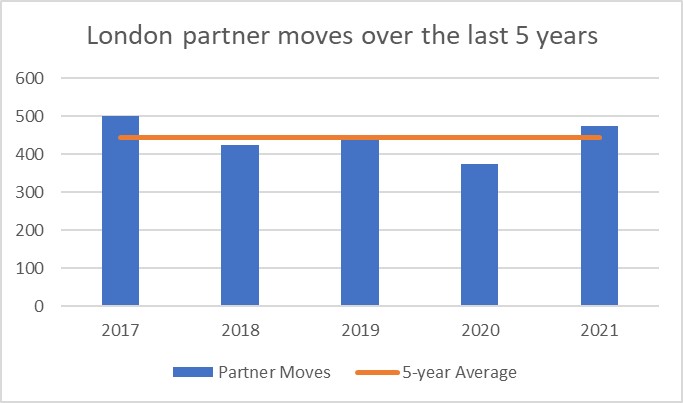

2021 saw a total of 473 announced partner moves – a 26% increase on the 374 moves we saw in 2020. This was respectively 7% above the five-year average (443) and 9% above the ten-year average (433). Indeed, aside from 2016 and 2017 (which were disproportionally elevated due to the voluntary and involuntary number of laterals entering the market associated with the collapse of King & Wood Mallesons’ European verein), 2021 was a record year for partner moves.

The most prolific hirer of 2021 was Kirkland & Ellis which - aided in part by its unusual partnership structure - hired 15 partners (albeit only 5 of whom were laterals), succeeded by White & Case which snapped up no fewer than 11. Following suit, Addleshaw Goddard and Greenberg Traurig each hired 10 partners.

Despite being the two most covetous firms, both White & Case and Kirkland & Ellis fell victim to the highest rates of attrition, losing 10 and 11 serving partners respectively. Unsurprisingly, in view of its imminent plans to list on the London stock exchange, Mishcon de Reya suffered the third highest rate of attrition, parting ways with 9 laterals in 2021.

| Top partner recruiters in London 2021 | Total hires | Lateral hires |

| Kirkland & Ellis | 15 | 5 |

| White & Case | 11 | 8 |

| Greenberg Traurig | 10 | 8 |

| Addleshaw Goddard | 10 | 7 |

| McDermott Will & Emery | 9 | 7 |

| DLA Piper | 9 | 7 |

| Taylor Wessing | 8 | 7 |

| Simmons & Simmons | 8 | 6 |

| DWF | 8 | 4 |

| Dentons | 8 | 6 |

In terms of laterals (partnership to partnership hires), a dozen firms hired six or more partners, with Greenberg Traurig and White & Case hiring the most with eight partners apiece.

|

Top partner recruiters in London 2021 (partnership to partnership moves only)

|

|

|

8 |

|

8 |

|

7 |

|

7 |

|

7 |

|

7 |

|

7 |

|

6 |

|

6 |

|

6 |

|

6 |

|

6 |

|

Firms with largest attrition in London 2021 (partnership to partnership moves only)

|

|

|

11 |

|

10 |

|

9 |

|

8* |

|

7 |

|

7 |

|

6 |

|

6* |

|

6 |

|

6* |

|

6 |

|

6 |

*Includes one lateral move from an overseas office into partnership at another firm in London.

In terms of rarity value, perhaps the most notable single lateral move was Weil Gotshal & Manges’ snaring of Slaughter and May corporate M&A lawyer Murray Cox – a lateral not even remotely close to that firm’s mandatory retirement age.

Alternative Law Firms

As per our methodology, Edwards Gibson only records hires by law firms with conventional partnership (or corporate) structures; nevertheless, it should be noted that, were we to do so, both Keystone Law and Gunner Cooke would likely feature in the rankings above. The difficulties in confirming a given lawyer’s location at these entities make like-for-like comparisons with conventional law firms particularly difficult. However, on a rough reckoning, Keystone hired 30 and Gunner Cooke hired 16 relevant partners – if correct, this would make them the highest and second-highest partner recruiters in London in 2021.

Top team moves in 2021

Altogether, nine firms made single team hires consisting of three or more partners. The single largest team hire of 2021 was Greenberg Traurig’s seven-partner fraud and disputes raid on the soon-to-be-listed Mishcon de Reya. Hogan Lovells also made its mark early in 2021 with a four-partner litigation team from Debevoise & Plimpton, consisting of an even split between lateral and promotional hires.

Gibson Dunn & Crutcher stands out for nabbing two separate three-partner corporate private equity teams in as many months from Vinson & Elkins and Sidley & Austin.

In addition, the following firms hired three-partner teams in 2021: Advant (finance from Grimaldi Studio Legale); Bracewell (energy from Clifford Chance); Paul Hastings (corporate crime from White & Case); Sidley Austin (finance from Vinson & Elkins); Taylor Wessing (corporate from Stephenson Harwood); and Willkie Farr & Gallagher (anti-trust from Quinn Emanuel Uquhart & Sullivan).

Other fun facts from 2021

- 28% of moves (133) were female;

- 4% of all moves - 20 in all - were in-house lawyers moving into law firm partnership;

- Including those moving from in-house, 135 lawyers moved from non-partner roles into partnership (29% of the total number of moves in 2021).

November - December 2021

This bi-monthly round-up contains 79 partner moves – up 36% on the 58 we saw during the same period in 2020 (and 34% greater than the cumulative five-year average for the same period – 59).

Top hirers this edition with three hires each were:

- Gibson Dunn & Crutcher

- Olaniwun Ajayi

- Taylor Wessing

- Wedlake Bell

Over the past two months, the most significant team move detailed in our edition below was Gibson Dunn & Crutcher’s raid on Sidley & Austin for a three-partner private equity team. The move comes just two months after the Los Angeles-born outfit snapped up another (infrastructure-heavy) private equity team from Vinson & Elkins (reported in our last edition).

It was announced in November that leading financial disputes lawyer Natasha Harrison is to leave her role as London managing partner of US litigation powerhouse Boies Schiller Flexner, to set up her own boutique. As the name of Harrison’s new entity has not yet been declared, this move is not recorded in our figures for this edition. It is probable that Harrison’s departure will result in further lateral departures from the US firm in 2022.

Four firms hired from in-house this round-up, making up 5% of the total: BCLP (from Bloomberg); Matheson (from Accenture); TLT (from the Government Legal Department); and Wiggin (from Three).

Market outlook for 2022

On both sides of the Atlantic, the Covid-induced lockdown year of 2020, and the subsequent economic bounce-back through 2021, have been kind to commercial law firms. In 2020 emergency legislative changes as well as commercial and contractual uncertainties triggered urgent requests for legal advice and dispute resolution assistance. When the economy roared back to life, aided by unprecedented government largess and unbridled optimism following successful vaccine roll outs, investor animal spirits took over. Since then, law firm deal teams have been flat out advising on corporate M&A and financings.

Better still, whilst law firm revenue typically increased, dramatic cost savings (from global travel restrictions, fewer entertainment expenses, rent reductions, etc.) coupled with productivity gains from the universal adoption of Zoom/Teams - as well as (now proven) efficiencies in associates working from home - meant that law firm profitability rose sharply in 2020.

Record revenue and profitability have provided law firms with the means and confidence to invest in new partner hires, so unsurprisingly 2021 was, in real terms, a record year for law firm partner recruitment.

At the time of writing, the legal boom continues with deal and disputes teams working flat out. With few exceptions, partners in almost every practice area, in every class of commercial law firm, need additional associate/fee earner support to service their practice. The sustained work levels combined with the new isolation of working on a screen from home appears to be taking a toll on associate and fee earner mental health and engagement, with many complaining of dissatisfaction and burnout. Law firms have responded, as they have since the dot-com bubble, with double-digit pay rises and generous bonus payments triggering an associate salary war.

Sharply increased fixed people costs, as well as associate churn, will doubtless blunt law firm profitability a tad, although whilst the tsunami of work continues, will be sustainable. Nevertheless, history tells us that law firm salary wars don’t tend to end well for associates, and more importantly for law firm management they have always been a portent of a market correction.

As of December 2021, much of Europe is re-entering some form of modified lockdown in response to the Covid Omicron variant. It remains to be seen what economic impact this will have, although with sharp rises in inflation, and already unprecedented peacetime government borrowing, if the West’s economy suffers a downturn, it is unclear how much room governments will have to provide additional stimulus. In that situation, law firms will doubtless hope to continue to defy gravity by benefiting from their inherently well-hedged business models.

Please do not hesitate to contact us if you would like to discuss this article or any other aspect of the market in more depth.

Scott Gibson, Director scott.gibson@edwardsgibson.com

Sloane Poulton, Director sloane.poulton@edwardsgibson.com

Mark Coates, Senior Consultant mark.coates@edwardsgibson.com

Please click here to understand our methodology for compiling Partner Moves

Download the full Partner Moves Issue here >>

If you would like to subscribe to our Partner Moves Newsletter, email us at support@edwardsgibson.com

Edwards Gibson Partner Round-Up - Our Methodology

Edwards Gibson Partner Round-Up - Our Methodology Previous editions of Partner Moves in London

Previous editions of Partner Moves in London Quantifying your following and writing an effective law firm business plan

Quantifying your following and writing an effective law firm business plan Specimen partner business plan template

Specimen partner business plan template The Partnership Track and Moving for Immediate Partnership

The Partnership Track and Moving for Immediate Partnership Legal directory rankings and their effect on lawyer recruitment

Legal directory rankings and their effect on lawyer recruitment Restrictive Covenants and Moving on as a Partner

Restrictive Covenants and Moving on as a Partner

What’s behind the escalating three-year bull run in Big Law Partner Hires in London and is it sustainable?

What’s behind the escalating three-year bull run in Big Law Partner Hires in London and is it sustainable?  Year End Big Law Tie Ups - and the standout is Hogan Lovells Cadwalader

Year End Big Law Tie Ups - and the standout is Hogan Lovells Cadwalader “To: Cc or not Cc” – Clifford Chance's subversive new branding

“To: Cc or not Cc” – Clifford Chance's subversive new branding  Two Big Law Summer Weddings … and an Anniversary

Two Big Law Summer Weddings … and an Anniversary Freshfields’ Non-Share Home Turf Handicap

Freshfields’ Non-Share Home Turf Handicap Big Law Jenga: How Private Capital Stars Are Making Elite Firms Unstable

Big Law Jenga: How Private Capital Stars Are Making Elite Firms Unstable Big Law’s Brave “Few”, Their Inevitable Pyrrhic Victory, and Why This Is Still a Tragedy for The Rule of Law

Big Law’s Brave “Few”, Their Inevitable Pyrrhic Victory, and Why This Is Still a Tragedy for The Rule of Law No Accounting for the Big Four in Big Law

No Accounting for the Big Four in Big Law