Download the full Partner Moves Issue here >>

Welcome to the 72nd edition of Law Firm Partner Moves in London, from the specialist partner team at Edwards Gibson, where we look back at announced partner-level recruitment activity in London over the past two months and give you a ‘who’s moved where’ update.

- A summary of 2022

2022 started with a searing-hot legal services market – the continuation of the post-covid economic bounce back, fuelled by ultra-loose monetary policies on both sides of the Atlantic, resulted in record law firm revenue and profitability, which in turn provided law firms with the largesse and confidence to invest in new partner hires.

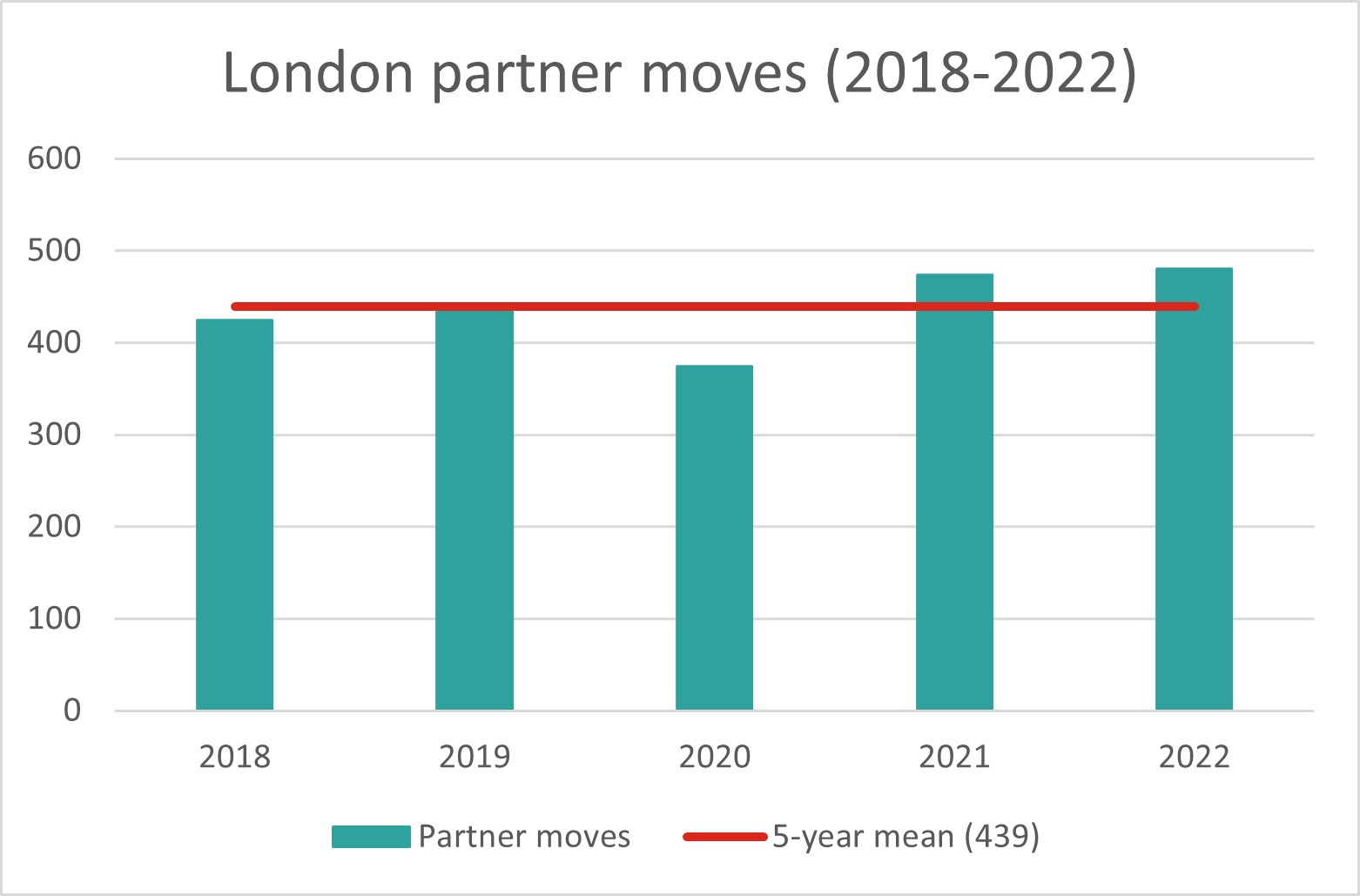

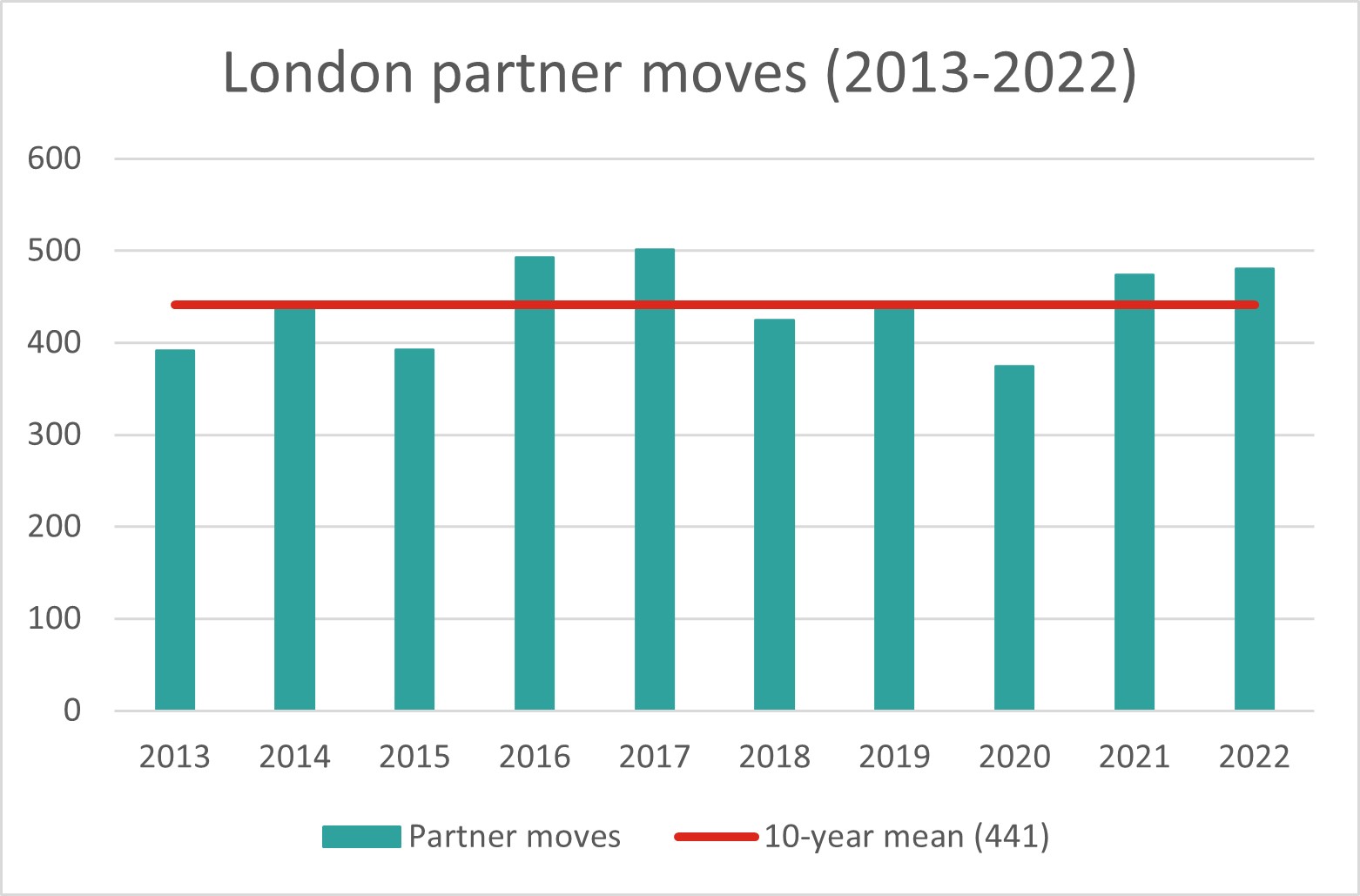

As we reported in July, the first half of the year saw a near record of announced partner hires. While the market in the second half, specifically the last two months, has predictably cooled in the face of a global economic slowdown and a looming UK recession, such was the frenetic pace of activity earlier in the year that 2022 narrowly beats 2021 for partner hires; 2022 saw a total of 480 announced partner moves - six more than the 474 we saw in 2021 and respectively 9% up on the five-year average (439) and 8% up on the 10-year average (441).

Indeed, aside from 2016 and 2017 (which were disproportionally elevated due to the voluntary and involuntary number of laterals entering the market associated with the collapse of King & Wood Mallesons’ European verein), 2022 was another “real terms” record year for law firm partner moves.

- Team hires 2022

Notable team hires in 2022 included: newly launched disputes boutique Pallas & Partners which hired 5 laterals from US firm Boies Schiller Flexner in January; and Paul Hastings which hired a 4-partner finance team from Latham & Watkins in July. Additionally, in March/April four firms hired three-partner teams: Harbottle & Lewis (TMT/data privacy from Deloitte Legal); Linklaters (leveraged finance/high yield) from Vinson & Elkins; Osborne Clarke (energy & finance from Orrick); and Ropes & Gray (private equity from Fried Frank).

The first rule of Dickson Minto is …

December saw the most dramatic team move of all - Milbank Tweed’s lock-stock and barrel acquisition of the London office of clandestine Scottish private equity boutique Dickson Minto. Whilst it had been known for some time that Dickson Minto’s London office was “in play”, long term market watchers will know that “the first rule of Dickson Minto is you don’t talk about Dickson Minto” so, whilst Milbank have confirmed to this publication that 7 laterals will indeed be joining its London office from Dickson Minto in the new year, the White Shoe firm will not confirm just who the septet are. Indeed, such is the secrecy surrounding the Caledonian spawned outfit that, at the time of writing, it is not possible for an outsider to determine with any certainty the names of all the Dickson Minto emigres which make the final line up - consequently the 7 laterals have not been recorded in this report nor our overall 2022 figures.

The most prolific hirer of 2022 was Eversheds Sutherland which welcomed 15 partners (10 of whom were laterals), succeeded by Kirkland & Ellis which snapped up no fewer than 13. Following suit, DLA Piper welcomed a dozen partners, Osborne Clarke hired 11 and Addleshaw Goddard, Mishcon de Reya, Paul Hastings and Squire Patton Boggs all hired 10 partners a-piece.

- Top partner recruiters in London 2022

| Top partner recruiters | Total hires | Lateral hires |

| Eversheds Sutherland | 15 | 10 |

| Kirkland & Ellis | 13 | 8 |

| DLA Piper | 12 | 10 |

| Osborne Clarke | 11 | 7 |

| Addleshaw Goddard | 10 | 7 |

| Mishcon de Reya | 10 | 6 |

| Paul Hastings | 10 | 9 |

| Squire Patton Boggs | 10 | 7 |

| CMS Cameron McKenna | 9 | 3 |

| Stephenson Harwood | 8 | 3 |

| Allen & Overy | 7 | 6 |

| DWF | 7 | 6 |

*Milbank Tweed would have had 8 lateral hires if the 7-partner Dickson Minto team move had been included (see above)

- Top partner recruiters in London 2022 (partnership to partnership moves only)

| Top partner recruiters | Lateral Hires |

| Eversheds Sutherland | 10 |

| DLA Piper | 10 |

| Paul Hastings | 9 |

| Kirkland & Ellis | 8 |

| Addleshaw Goddard | 7 |

| Osborne Clarke | 7 |

| Squire Patton Boggs | 7 |

| Allen & Overy | 6 |

| DWF | 6 |

| Mishcon de Reya | 6 |

*Milbank Tweed would have had 8 lateral hires if the 7-partner Dickson Minto team move had been included (see above)

BCLP again fell victim to the highest attrition, losing 15 serving partners, followed by Dentons which lost 11, then Brown Rudnick and Norton Rose Fulbright - which both parted ways with 10 laterals. Nevertheless, in proportion to the size of their London partnerships, the firms with the highest rate of lateral attrition in Big Law were US disputes boutique Boies Schiller Flexner followed by Boston headquartered Brown Rudnick.

- Firms with largest attrition in London 2022 (partnership to partnership moves only)

| Highest attrition rate | No. laterals lost |

| BCLP | 15* |

| Dentons | 11 |

| Brown Rudnick | 10 |

| Norton Rose Fulbright | 10 |

| Kirkland & Ellis | 8 |

| DLA Piper | 6 |

| Hogan Lovells | 6 |

| Latham & Watkins | 6 |

| Memery Crystal | 6 |

| BLM | 5 |

| Boies Schiller | 5 |

| White & Case | 5 |

*1 lateral departure was from BCLP’s Manchester office to DWF in London

- Hyperactive magic circle

2022 has collectively seen by far the greatest number of partner hires by magic circle law firms – 21 (of whom 17 were laterals). The previous record, set in 2016, was 12 (typically the magic circle tends to hire between 4 and 8 partners in London p/a). The most acquisitive magic circle firm this year was Allen & Overy which welcomed 7 partners, followed by Clifford Chance (6), Linklaters (5), and Freshfields (3).

- Alternative Law Firm

As per our methodology, Edwards Gibson only records hires by law firms with conventional partnership (or corporate) structures; nevertheless, it should be noted that, were we to do so, Keystone Law would likely feature at the top of the rankings above. The difficulties in confirming a given lawyer’s location at these entities make like-for-like comparisons with conventional law firms particularly challenging. However, on a rough reckoning, Keystone hired 24 relevant partners in 2022.

- Other fun facts from 2022

- 32% of moves (153) were female, slightly up on the five-year average at 28%;

- 3% of all moves – 16 in all – were in-house lawyers moving into law firm partnership;

- Including those moving from in-house, 149 lawyers (31%) moved from non-partner roles into partnership.

- November – December 2022

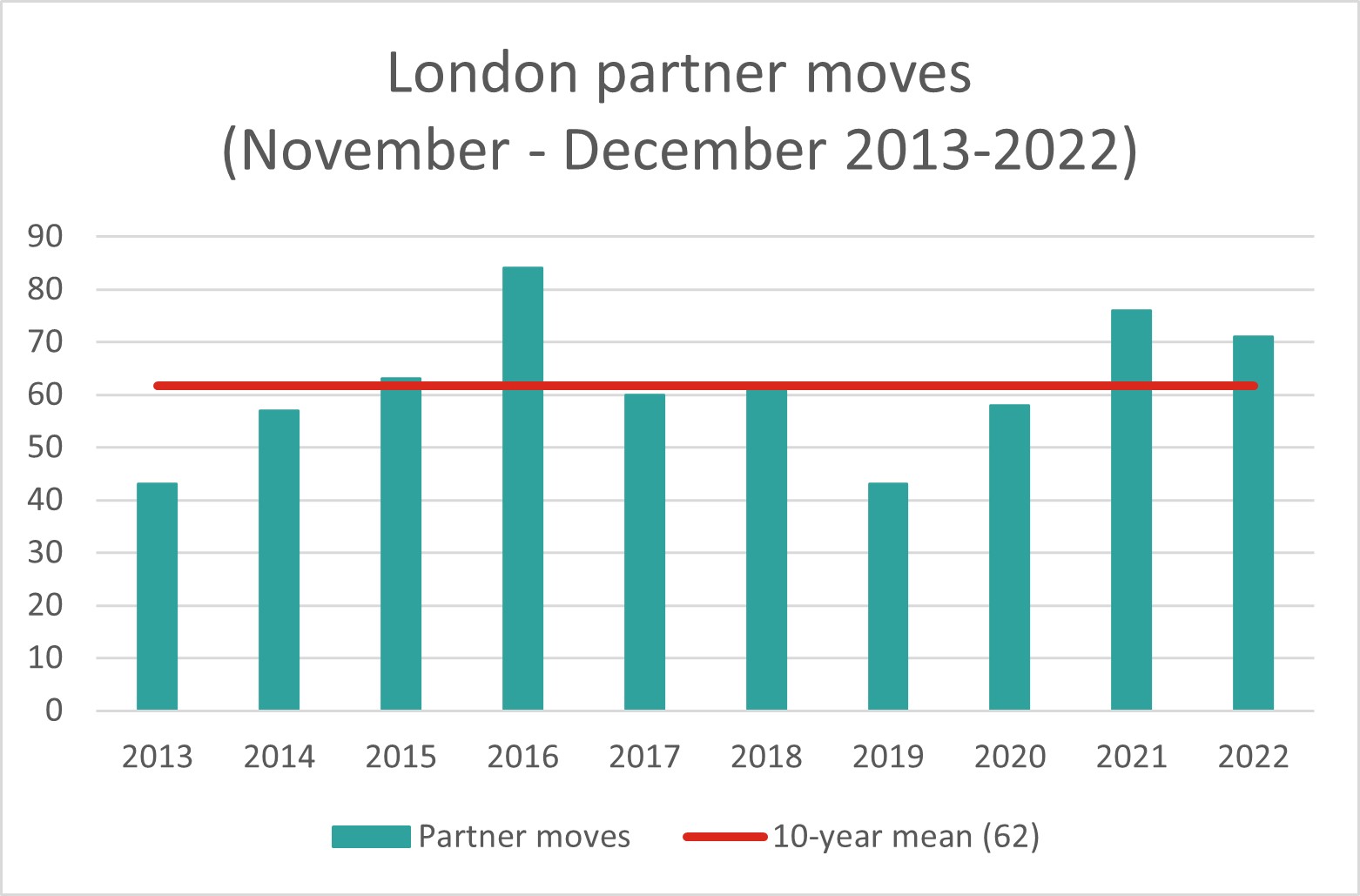

This bi-monthly round-up contains 71 partner moves – down 7% on the 76 we saw for the same period in 2021 (but still 13% up on the cumulative five-year and ten-year averages for the same period – 62 for both).

Aside from the 7, as yet unspecified, laterals joining Milbank Tweed from Dickson Minto (not covered in this edition - see above), the most prolific hirers over the past two months were DLA Piper and Boston-born, Goodwin Proctor, which hired 3 partners a-piece.

- Market Outlook for 2023

In our August edition we mentioned that it was “passing strange that in the context of: rising interest rates, skyrocketing inflation, a global energy crisis, international trade tensions, 1970’s-style industrial unrest, crippling government debt, UK political chaos, the fracturing of the post-World War Two global rules-based system … not to mention a full scale European land war, that law firm partner recruitment remains at near record levels” … and so it remains.

Despite law firms facing sharply elevated fixed costs - in large part due to a nearly two-year long associate salary war on both sides of the Atlantic - and, since around June, reports of declining activity in many departments, law firm partner recruitment has remained surprisingly robust even allowing for the often considerable post resignation lag times experienced by many UK laterals.

Nevertheless, although law firms are intrinsically well hedged businesses, history tells us that the legal recruitment market will soften appreciably next year. Worse, for many law firms, rising global interest rates may dampen that more than decade long driver of Big Law - private equity. If so, it will not just adversely impact transactional lawyers but also those many disputes lawyers who may not even realise just how much they have come to rely on private equity backed litigation funders.

Please do not hesitate to contact us if you would like to discuss this article or any other aspect of the market in more depth.

Scott Gibson, Director scott.gibson@edwardsgibson.com or +44 (0)7788 454 080

Sloane Poulton, Director sloane.poulton@edwardsgibson.com or +44 (0)7967 603 402

Please click here to understand our methodology for compiling Partner Moves

Download the full Partner Moves Issue here >>

If you would like to subscribe to our Partner Moves Newsletter, email us at support@edwardsgibson.com

Edwards Gibson Partner Round-Up - Our Methodology

Edwards Gibson Partner Round-Up - Our Methodology Previous editions of Partner Moves in London

Previous editions of Partner Moves in London Quantifying your following and writing an effective law firm business plan

Quantifying your following and writing an effective law firm business plan Specimen partner business plan template

Specimen partner business plan template The Partnership Track and Moving for Immediate Partnership

The Partnership Track and Moving for Immediate Partnership Legal directory rankings and their effect on lawyer recruitment

Legal directory rankings and their effect on lawyer recruitment Restrictive Covenants and Moving on as a Partner

Restrictive Covenants and Moving on as a Partner

What’s behind the escalating three-year bull run in Big Law Partner Hires in London and is it sustainable?

What’s behind the escalating three-year bull run in Big Law Partner Hires in London and is it sustainable?  Year End Big Law Tie Ups - and the standout is Hogan Lovells Cadwalader

Year End Big Law Tie Ups - and the standout is Hogan Lovells Cadwalader “To: Cc or not Cc” – Clifford Chance's subversive new branding

“To: Cc or not Cc” – Clifford Chance's subversive new branding  Two Big Law Summer Weddings … and an Anniversary

Two Big Law Summer Weddings … and an Anniversary Freshfields’ Non-Share Home Turf Handicap

Freshfields’ Non-Share Home Turf Handicap Big Law Jenga: How Private Capital Stars Are Making Elite Firms Unstable

Big Law Jenga: How Private Capital Stars Are Making Elite Firms Unstable Big Law’s Brave “Few”, Their Inevitable Pyrrhic Victory, and Why This Is Still a Tragedy for The Rule of Law

Big Law’s Brave “Few”, Their Inevitable Pyrrhic Victory, and Why This Is Still a Tragedy for The Rule of Law No Accounting for the Big Four in Big Law

No Accounting for the Big Four in Big Law